Roku Stock Forecast: A Comprehensive Guide for Investors in 2024 and Beyond

Introduction

The Roku stock forecast is a topic of keen interest for investors looking to tap into the streaming market’s growth potential. As a major player in the streaming and digital media space, Roku has carved out a unique position in the industry. Understanding the factors that drive Roku’s stock performance is essential for investors aiming to make informed decisions. This blog post covers various aspects influencing the Roku stock forecast, from financial performance and market dynamics to competitive forces and technological trends, offering a complete overview of where Roku stock may be headed in 2024 and beyond.

Roku’s Business Model

To make an accurate Roku stock forecast, it’s important to first understand Roku’s business model. Roku generates revenue from two primary sources: device sales and platform services. While Roku’s hardware devices are popular among consumers, the company’s main revenue driver is its platform segment, which includes advertising, licensing, and subscription revenue. Roku’s ability to monetize its platform through ads and partnerships significantly impacts the Roku stock forecast, as this segment has shown high growth potential.

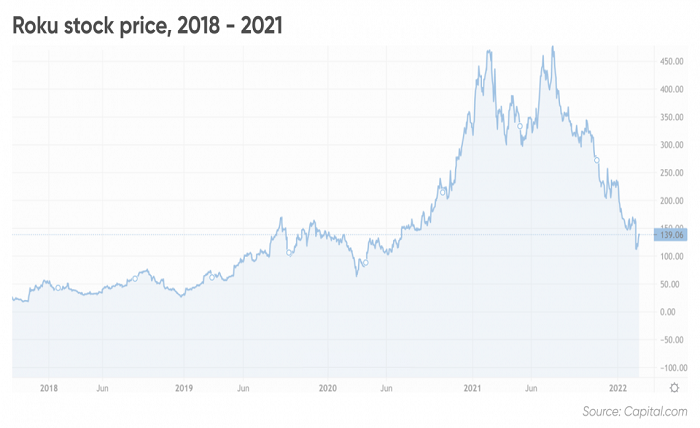

The Current State of Roku Stock

An essential element of any roku stock is evaluating Roku’s current stock performance. Roku stock has seen fluctuations due to factors like quarterly earnings reports, market sentiment, and external economic factors. As of [current date], Roku stock is trading at [current stock price], reflecting both the volatility in the streaming sector and broader economic challenges. By analyzing Roku’s recent performance and comparing it to industry trends, investors can gain a clearer picture of the Roku stock forecast for the upcoming quarters.

Key Factors Influencing Roku Stock Forecast

The Roku stock forecast is shaped by several key factors, including market demand for streaming services, the company’s ability to expand its ad revenue, and its competitive positioning. Roku’s stock forecast is also impacted by macroeconomic trends such as consumer spending patterns, inflation, and advertising budgets. Additionally, innovations in streaming technology and Roku’s efforts to diversify its revenue streams will play a crucial role in shaping its stock forecast.

Financial Performance and Roku Stock Forecast

Roku’s financial performance is a core aspect of its stock forecast. Analyzing Roku’s quarterly earnings, revenue growth, and profit margins provides valuable insight into its financial health. In recent quarters, Roku has reported substantial growth in platform revenue, though device sales have fluctuated due to supply chain issues and inflation. Positive financial indicators like high revenue from advertising and licensing strengthen the Roku stock forecast, while challenges like increased operating costs can dampen its outlook.

Roku’s Position in the Competitive Landscape

An accurate Roku stock forecast requires considering Roku’s competitive landscape. Roku competes with major streaming platforms such as Amazon Fire TV, Apple TV, and Google Chromecast. Roku’s unique value proposition lies in its platform-agnostic approach, allowing users to access multiple streaming services from one device. Roku’s competitive positioning is advantageous, but increased competition and market saturation in the streaming industry could influence its stock forecast. Staying competitive and expanding its market share are vital for Roku’s long-term stock performance.

Technological Trends and Their Impact on Roku Stock Forecast

Technology trends such as the shift towards connected TVs, advancements in streaming quality, and increased adoption of ad-supported content directly impact the Roku stock forecast. As consumers continue to embrace streaming as their primary form of media consumption, Roku’s commitment to enhancing user experience and introducing new platform features strengthens its stock forecast. Additionally, Roku’s investment in data analytics for personalized ad targeting can improve its ad revenue, positively impacting the Roku stock forecast in the long run.

Expert Opinions on Roku Stock Forecast

Expert opinions and analyst ratings contribute significantly to the Roku stock forecast. Many financial analysts provide price targets and growth projections based on factors such as Roku’s revenue potential, market expansion, and competitive dynamics. For instance, analysts who are bullish on Roku highlight its strong ad revenue potential and strategic partnerships. However, some analysts remain cautious, pointing to competition and potential regulatory changes as challenges to the Roku stock forecast. Investors benefit from considering these expert insights when evaluating Roku’s stock prospects.

Long-Term Growth Prospects for Roku Stock

A vital component of the Roku stock forecast is assessing the company’s long-term growth prospects. With the increasing shift toward digital media consumption, Roku is well-positioned to capitalize on the growth of ad-supported streaming. Roku’s international expansion, strategic acquisitions, and potential new revenue streams from subscription services contribute to its long-term stock forecast. A favorable long-term growth outlook for Roku stock depends on the company’s ability to innovate and adapt to changing market conditions, making it a potentially attractive investment.

Read more about : however synonym

Challenges Facing Roku Stock Forecast

No Roku stock forecast would be complete without acknowledging the challenges the company may face. Roku’s heavy reliance on advertising revenue makes it susceptible to economic downturns, which could result in reduced ad spending. Furthermore, rising competition from well-funded tech giants and potential regulatory changes could impact Roku’s profitability. Understanding these challenges allows investors to weigh the risks and rewards associated with Roku stock, painting a balanced picture of the Roku stock forecast.

Tips for Investing in Roku Stock

For those interested in investing based on the Roku stock forecast, a few strategies can help manage risk and optimize returns. Diversifying investments across tech and media sectors can mitigate risks tied to Roku’s stock volatility. Additionally, keeping an eye on quarterly earnings, market trends, and analyst recommendations can offer valuable insights into the best times to buy or sell Roku stock. Given Roku’s fluctuating stock performance, a long-term approach that focuses on Roku’s growth potential and industry positioning may yield favorable returns.

Conclusion

In conclusion, the Roku stock forecast presents a mix of potential growth opportunities and challenges. As a leader in the streaming and connected TV space, Roku is strategically positioned to benefit from the increasing demand for digital media and ad-supported content. Factors like technological advancements, strong financial performance, and international expansion positively influence Roku’s stock forecast, while competition and economic fluctuations pose notable challenges. By understanding the multifaceted elements that shape the Roku stock forecast, investors can make informed decisions and align their strategies with Roku’s evolving market presence.

FAQs

1. What is the Roku stock forecast based on?

The Roku stock forecast is based on factors like the company’s financial performance, market demand for streaming, competition, technological advancements, and expert opinions. Each of these factors plays a role in shaping expectations for Roku’s future stock performance.

2. How does Roku’s revenue model affect its stock forecast?

Roku’s revenue model, which includes device sales and platform revenue (mainly from advertising), significantly impacts the Roku stock forecast. As platform revenue grows, driven by ads and subscriptions, it positively affects the stock forecast by providing a steady income stream.

3. What challenges could negatively impact the Roku stock forecast?

Key challenges affecting the Roku stock forecast include economic downturns (which could reduce ad spending), increased competition from other streaming platforms, and potential regulatory changes. These factors may influence Roku’s profitability and stock performance in the future.

4. Is the Roku stock forecast optimistic or cautious?

The Roku stock forecast varies among experts. While some analysts are optimistic due to Roku’s growth in ad revenue and international expansion, others take a cautious view, citing competition and market volatility. Investors are advised to consider multiple perspectives.

5. Should I invest in Roku stock based on the current forecast?

Deciding to invest based on the Roku stock forecast depends on your financial goals and risk tolerance. Roku stock has growth potential, but it also faces challenges. A long-term investment approach and portfolio diversification can help manage risks tied to Roku’s stock.

Read more about : rangoli designs